Entering a new market is high stakes decision. Irrespective of the country or region or segment, a robust market entry strategy backed by research and execution support can make the difference between success and costly missteps.

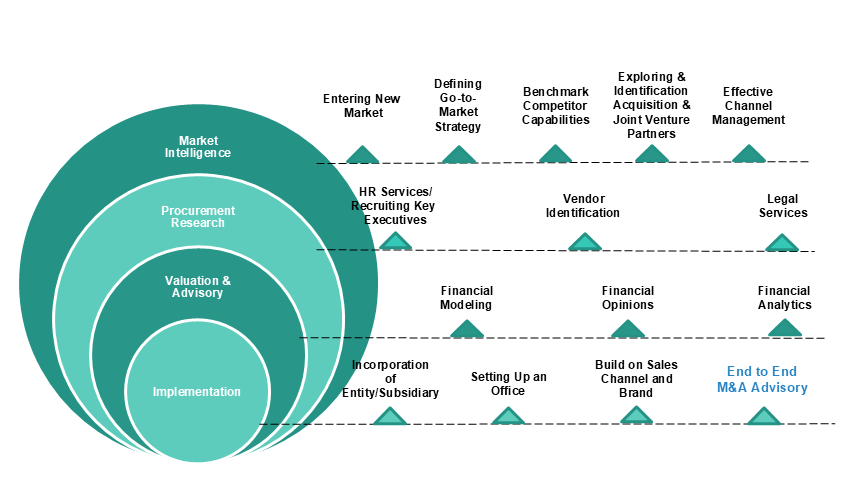

At BIS Research, we provide end-to-end market entry consulting services — from market feasibility studies and regulatory compliance to competitor benchmarking and go-to-market (GTM) plans.

MARKET ENTRY SOLUTIONS : ACCESS NEW MARKETS WITH CONFIDENCE

Why You Need a Market Entry Strategy?

| Mitigate Risk | Accelerate Growth | Optimize Costs | Win Market Share |

| Identify regulatory barriers, tariffs, and compliance pitfalls before you commit. | Leverage competitor benchmarking and consumer insights to win faster. | Align supply chain, sourcing, and pricing with regional dynamics. | Execute with confidence using our ready-to-implement GTM playbooks. |

Healthcare & Pharma

Technology

BIS Research empowers healthcare and pharmaceutical companies to successfully navigate new markets by providing a comprehensive understanding of the sector-specific landscape, including regulatory pathways (e.g., FDA, EMA approvals), market access challenges, competitor analysis, and the evolving impact of tariffs on drug and medical device supply chains

- We offer a ready-to-execute strategy tailored for new market's dynamic healthcare landscape, including the life sciences, med tech and pharma.

- Our approach involves a customised go-to-market plan, identification of key opinion leaders, and targeting high-potential customer segments.

Partner with BIS Research to unlock the full potential of the Semiconductor, Advanced Materials, Mobility and Emerging Technology sectors. Our commitment to excellence, combined with a deep understanding of industry trends, positions us as your trusted partner in achieving sustained success in the rapidly evolving world of technology.

Core Deliverables

- Market Feasibility Study Services — assess market size, growth drivers, and entry barriers.

- Regulatory Compliance Consulting — map local approval pathways and legal frameworks.

- Competitor Benchmarking for Market Entry — pricing, distribution, and customer acquisition strategies.

- Go-to-Market Strategy Consultants — detailed launch playbooks with distribution channels.

- Partner & Distributor Mapping — shortlist qualified suppliers, distributors, and channel partners.

Industry-Specific Solutions

- Pharma Market Entry Strategy India: Navigate approvals, partnerships, and pricing.

- Medtech Go-to-Market Strategy: Engage hospitals and healthcare systems.

- EV Market Entry Strategy: Build supplier networks and sourcing frameworks.

- Semiconductor Market Entry Consulting: Secure manufacturing and component ecosystems.

- Food & Beverage Market Entry Strategy: Retail, e-commerce, and FMCG distribution.

India ENTRY Success Story: US Based Consumer Tech Startup

• Identify partners for manufacturing in India

• Ensure feet on the ground for quality control

• Local management level folks to represent the client

• Market research to profile and shortlist suppliers

• Local recruitment, onboarding and payroll support for quality control team memer

• Resolve any technical and logistical challenges during test runs

SUCCESSFUL ENGAGEMENTS

| AMR Molecular Diagnostics Panels in India |

A diagnostics company aimed to launch AMR Mol Dx test panels in India.

-

BIS Research delivered a precise, data-driven market entry strategy

-

Helped position the client’s AMR panels as a cost-effective, clinically vital diagnostic solution

-

Highlighted strong adoption potential within India’s evolving healthcare landscape.

| Indian Cell Therapy Reagents Market |

Identify high-growth opportunities aligned with its strengths in antibodies and antigens.

- Clear view of India’s cell therapy reagent landscape

- Identified top reagent categories for entry

- Developed a strategic product roadmap

- Mitigated market and regulatory risks with tailored insights

| Oncology NGS Testing in India |

To assess India’s oncology-focused NGS market, aiming to develop a localized market entry strategy

- Identified key opinion leaders (KOLs) and high-potential customer segments

- Anticipated regulatory/reimbursement challenges early

- Aligned product roadmap and investments with market gaps and growth drivers

| Data Center Cooling Market |

The aim was to navigate the evolving market, key entry points, regulatory challenges, and competitor moves to tap into the rising demand for efficient solutions.

- Comprehensive analysis involving over

60 industry experts - Market entry strategy for multiple regions

in 12-18 months. - Identifying optimal cooling technologies

for different climates.

| CCUS Market Solutions |

products, and emerging applications for strategic expansion.

- Identified 20 high-potential competitors from a broad pool

- Targeted emerging European markets for future growth insights

- Mapped total carbon capture market potential by emission sources for Europe and North America

- Delivered strategic insights into capture technologies and product applications

| Biocomposites Materials Market Analysis |

▪ SWOT and quadrant analysis revealing strategic positions of competitors

▪ Focus on key performance attributes: strength, biodegradability, cost-effectiveness

What BIS Advisory Services can help you with?

India-First Market Entry Strategy

Global supply chains are shifting, and India is emerging as a primary manufacturing hub. Choosing an India-First strategy delivers:

- Competitive Economics: Skilled workforce and favorable production costs.

- Government Incentives: Production-linked schemes and simplified compliance.

- Supplier Diversity: Electronics, pharma, textiles, and auto component ecosystems.

- Reduced Dependency on China: Hedge against geopolitical and trade risks.

How U.S. Tariffs Are Reshaping India and China as Manufacturing Hubs

Recent U.S. tariff policies are forcing companies to reevaluate manufacturing footprints:

- Higher Export Costs: New tariff hikes raise landed costs for Indian and Chinese exports to the U.S.

- Diversification Strategy: Firms are splitting production across India, Southeast Asia, and Mexico to reduce tariff exposure.

- India-First Advantage: Despite tariffs, India offers lower compliance risk, government incentives, and supplier reliability, making it a strong long-term bet.

- Action Required: Businesses must run tariff-adjusted pricing models and build phased entry roadmaps — starting with pilots and scaling exports as trade clarity emerges.

CLIENT DIARIES

.png?width=1200&length=1200&name=image%20(12).png)